Results for "manila water"

The Manila Water Concessions and Philippine Water Privatization with Iris Gonzales

Iris Gonzales, Philippine Star reporter and columnist, provides an eye-opening discussion on water in the Philippines and the Manila water concessions. Iris also explains the impact of the recently enacted legislative franchises granted by the Filipino government. In this session, you’ll learn about: Iris’ coverage of water in the Philippines How the Philippines set up water utilities… Continue reading The Manila Water Concessions and Philippine Water Privatization with Iris Gonzales

Manila Water Matures with Tariff Revisions

On 15 May 2015, Metropolitan Waterworks & Sewerage System (MWSS) Regulatory Office approved rate adjustments for Manila’s water utility concessionaires. Manila Water Company Inc. faces a 2.42% tariff reduction (PHP0.63/m3). Maynilad, on the other hand, will implement a 4.19% (PHP1.35/m3) tariff increase. These adjustments are the net effect of delayed inflation indexing, provisional increases, and arbitration between MWSS and Manila Water over the last three years.

Manila Water Enters New Frontier in Myanmar

On 18 March 2014, the Yangon City Development Committee (YCDC) of Myanmar, Manila Water Corporation (MWC), and Mitsubishi Corporation signed an MOU for a non-revenue water (NRW) reduction project. The project involves leak detection, pipe upgrades, and installation of meters and fee collection systems on a small scale. It will cost approximately US$1 million for the project and enable roughly 10,000 connections in central Yangon. MWC implemented similar measures in the East Manila city and seeks to replicate this experience in Yangon.

Manila Water Diversifies Southeast Asia Position

On 21 August 2013, the MWC acquired a 31.46% stake in Vietnam water utility SWIC. The deal needs to be ratified by SWIC within 105 days. SWIC, formerly Saigon Infrastructure Real Estate Investment Joint Stock Company, shifted its focus in 2011 toward integrated water and wastewater treatment services.

The Philippines Extends Water PPPs Beyond Manila

Private water concessions in Manila have driven water coverage from under 60% to nearly 100% between 1997 and 2015 and created a more positive environment for private company participation going forward. Out of this transformation have emerged domestic players, Manila Water Company and Maynilad, which have become global benchmarks for water infrastructure public-private partnerships (PPP) in developing countries. Their success points to additional private water infrastructure investment beyond Manila that hinges on a mix of regulations formalizing water districts, standardizing contract structures, and guaranteeing contracts to attract investors. Bluefield Research has released a new Market Insight, The Philippines Extends Water PPPs Beyond Manila, which analyzes the emerging opportunities in the Philippines to develop its municipal water market nationally. The country’s PPP Center has nine strategic projects lined up through 2020.

The Philippines Extends Water PPPs Beyond Manila

Report Excerpt: The Essential Guide To Financing Smart Water Projects

On 28 of July 2017, Master Meter, in collaboration with Water Finance & Management, released, The Essential Guide To Financing Smart Water Projects. This ebook provides an overview on water infrastructure financing, the growing investment in smart water technology, and how these critical projects are being funded. The report draws heavily from Bluefield Research’s in-depth analysis of… Continue reading Report Excerpt: The Essential Guide To Financing Smart Water Projects

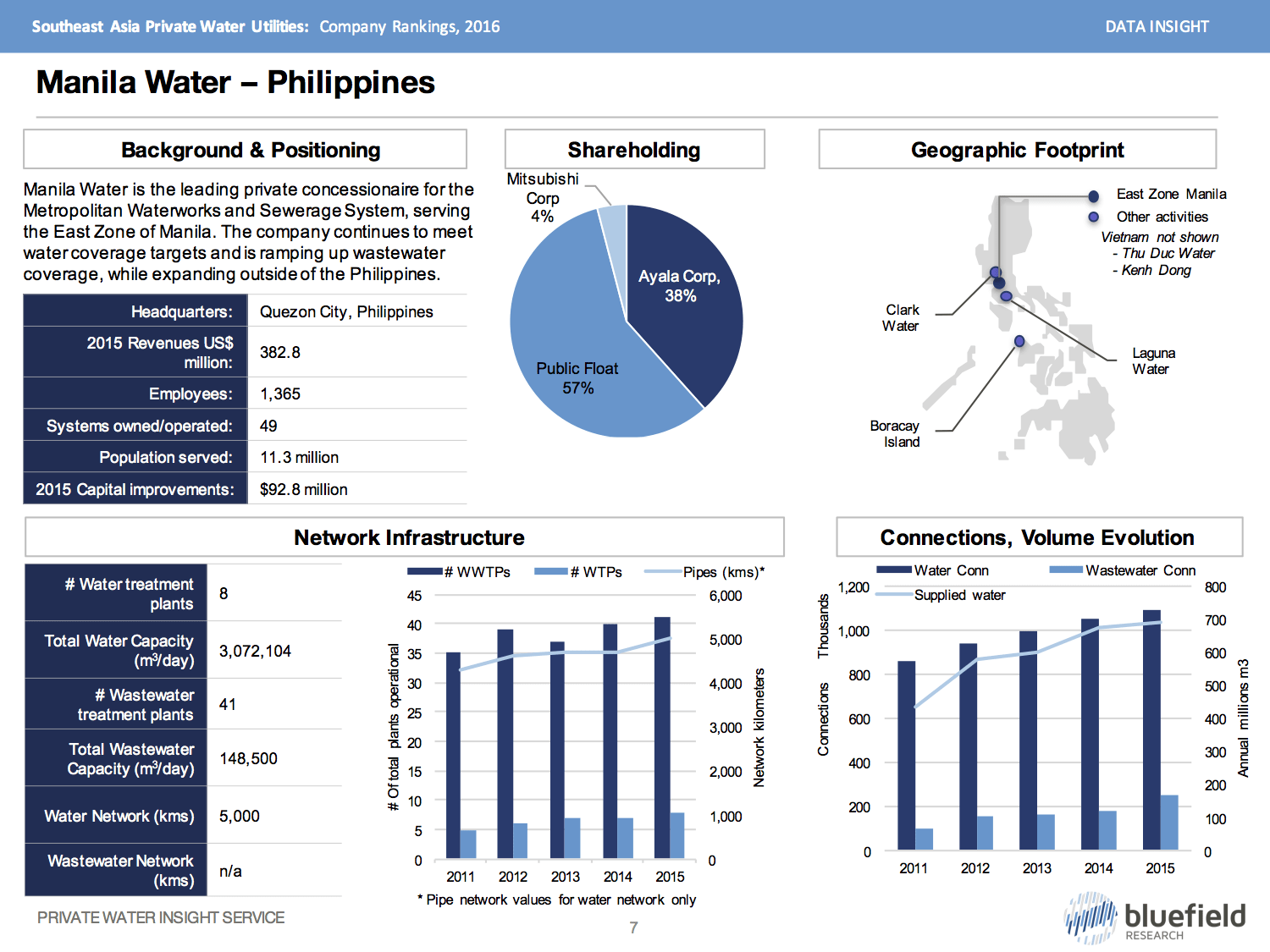

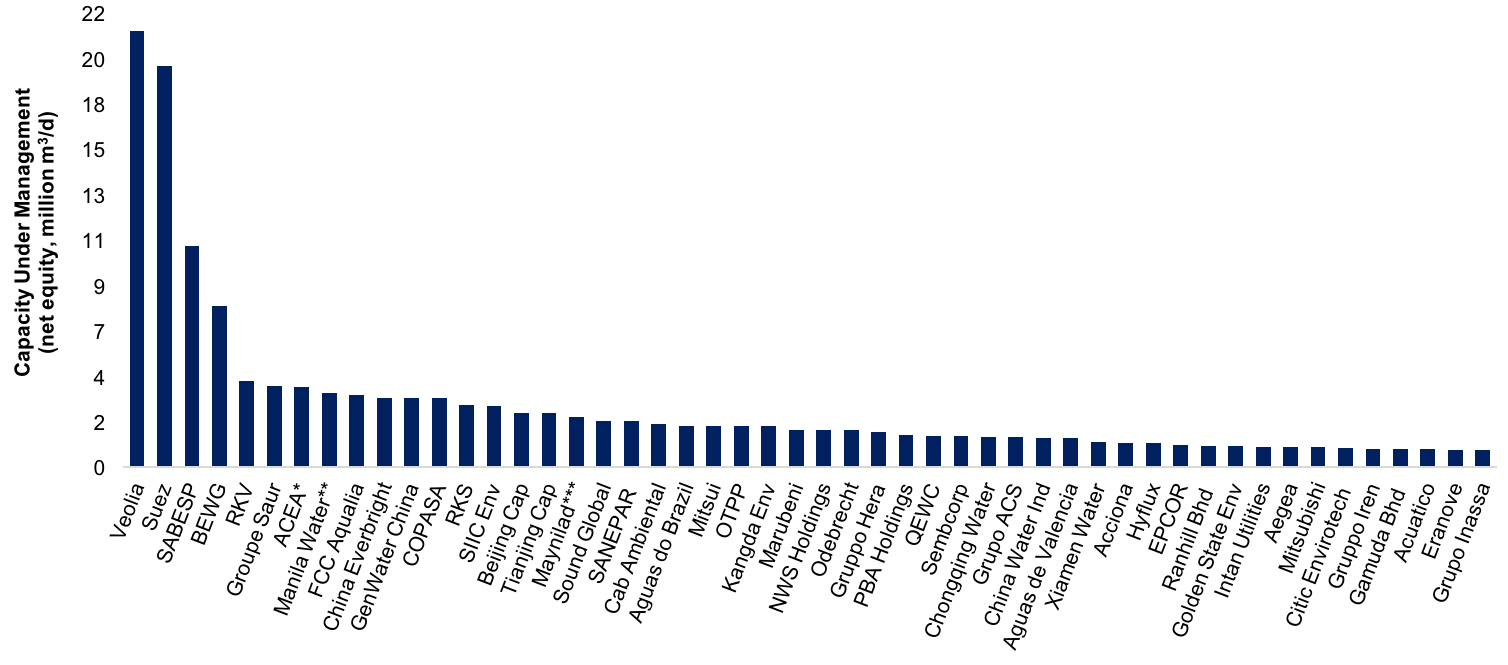

Southeast Asia Private Water Utilities: Company Rankings, 2016

Global Water PPP Market to Triple by 2020

Many countries are facing a perfect storm of financing constraints and water infrastructure shortfalls. Dramatic declines in oil and commodity prices, low water tariffs, groundwater overdrafts, and untreated wastewater discharge are prompting governments to tap the private sector through public-private partnership (PPP) schemes. According to a new report by Bluefield Research, the global market for water PPP projects is set to nearly triple between 2016 and 2020, adding an average of 16 million m3/day of treatment capacity annually versus approximately 6 million m3/day between 2010 and 2015. Total investment during the period is expected to surpass US$58 billion, of which 80% will target new seawater desalination and wastewater treatment plants.