This policy brief is for U.S. & Canada Municipal Water Corporate Subscription clients.

Exhibit: Table of Authorizations

Program | New or Existing | Enabling Statue or Agency Purview | 2022-2026 Authorization (USD) |

|---|---|---|---|

Assistance for Small and Disadvantaged Communities | Existing | Safe Drinking Water Act | $510M |

Research Investigations, Training, Information | Existing | Clean Water Act | $375M |

Sewer Overflow and Stormwater Reuse Municipal Grants | Existing | Clean Water Act | $280M |

WIFIA | Existing | EPA | $250M |

Operational Sustainability of Small Public Systems | New | Drinking Water and Wastewater Infrastructure Act of 2021 | $250M |

Midsize and Large Drinking Water System Infrastructure Resilience and Sustainability Program | New | Drinking Water and Wastewater Infrastructure Act of 2021 | $250M |

Indian Reservation Drinking Water | Existing | Safe Drinking Water Act | $250M |

Connection to Publicly Owned Treatment Works | New | EPA | $200M |

Clean Water Infrastructure Resiliency and Sustainability Program | New | Drinking Water and Wastewater Infrastructure Act of 2021 | $125M |

Alternative Water Source Pilot | Existing | EPA | $125M |

Wastewater Efficiency Grant Pilot | New | EPA | $100M |

Water Data Sharing pilot | New | Clean Water Act | $75M |

Technical Assistance Grants for Public Water Systems Emergencies | Existing | Safe Drinking Water Act | $75M |

Advanced Drinking Water Technologies | New | Drinking Water and Wastewater Infrastructure Act of 2021 | $50M |

Stormwater Infrastructure Technology | New | Drinking Water and Wastewater Infrastructure Act of 2021 | $50M |

Innovative Water Infrastructure Workforce Development Program | Existing | EPA | $25M |

Enhanced Aquifer Use and Recharge | New | EPA | $25M |

Cybersecurity Support for Public Water Systems | New | Drinking Water and Wastewater Infrastructure Act of 2021 | TBD |

Total | $3.015B |

Buy America: Domestic Sourcing Requirements

The IIJA, like other infrastructure-related federal funding laws dating back as far as the 1930s, has some requirements that favor U.S. made or sourced building materials and products. Whereas recent “Buy America” requirements in infrastructure related programs like the American Recovery and Reinvestment Act (ARRA) of 2009 primarily related to iron, steel, and a narrow range of manufactured goods, the IIJA broadens this coverage to include nonferrous metals, plastic- and polymer-based products, glass, optical fiber, lumber, and drywall. To be considered “produced in the United States” under IIJA, manufactured goods must contain greater than 55% of domestic content, a figure that has now been raised to 60% for items delivered in 2022-2023, and may eventually be raised to 75% for items delivered starting in 2029. The law directs the White House’s Office of Management and Budget (OMB) to define relevant manufacturing processes as they relate to construction materials, and instructs Federal agencies to submit to OMB and Congress a report that identifies each financial assistance program for infrastructure administered by the agency and identify Buy America requirements that are relevant.

The OMB’s Made in America Office is tasked with increased enforcement and compliance with domestic sourcing requirements and serves as the final authority in reviewing waiver requests for projects using federal funds. Waiver criteria includes demonstrations where Buy America requirements are inconsistent with the public interest, where products and materials are not domestically available in sufficient quantity or quality, and if the use of domestic products and materials raises the total cost of a project by more than 25%.

Announced Funding Update

The U.S. White House has been releasing periodic progress reports showcasing IIJA funding announced to date. The latest update, which included data as of 17 March 2023, showed that US$197.4 billion in IIJA funding has been announced for infrastructure improvement projects across the nation, which is about 36% of the total US$560 billion for new spending included in the legislation. These announced funds are money that has been put into the pipeline to some extent, distributed to specific states, but it has not necessarily been spent or allocated to specific projects yet. While funding is starting to make its way down to the project level, specific numbers for these projects are not available yet, as it is still very early in this stage.

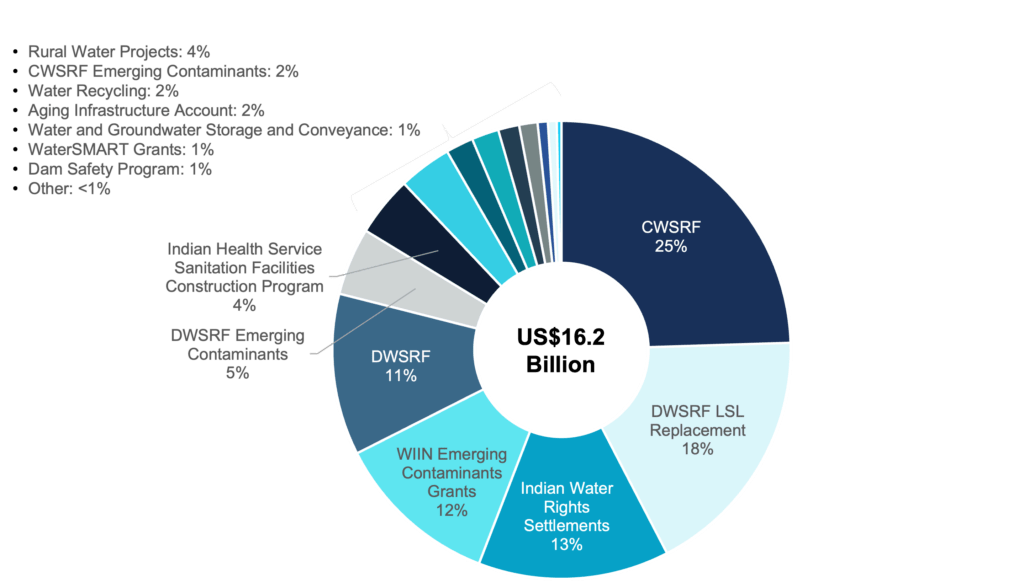

Of the 12 funding subcategories, water has received the second-largest sum of announced funding as of March 2023, representing 8% at US$16.2 billion. When looking at the specific water sector channels, 61% of announced water-related project funds to date are being distributed through the EPA’s SRF program, with the largest portion of announced funding is set to be distributed through the Clean Water SRF, accounting for approximately US$4 billion, or 25% of total announced water funding.

Exhibit: Announced Water Sector Funding by Program

Note: “Other” category includes Safety of Dams, Water Sanitation, and Other Facilities; Tribal Irrigation and Power Systems; and Geographic Programs (Columbia River Basin Restoration Program, Southeast New England Coastal Watershed Restoration Program)

Source: U.S. White House, Bluefield Research

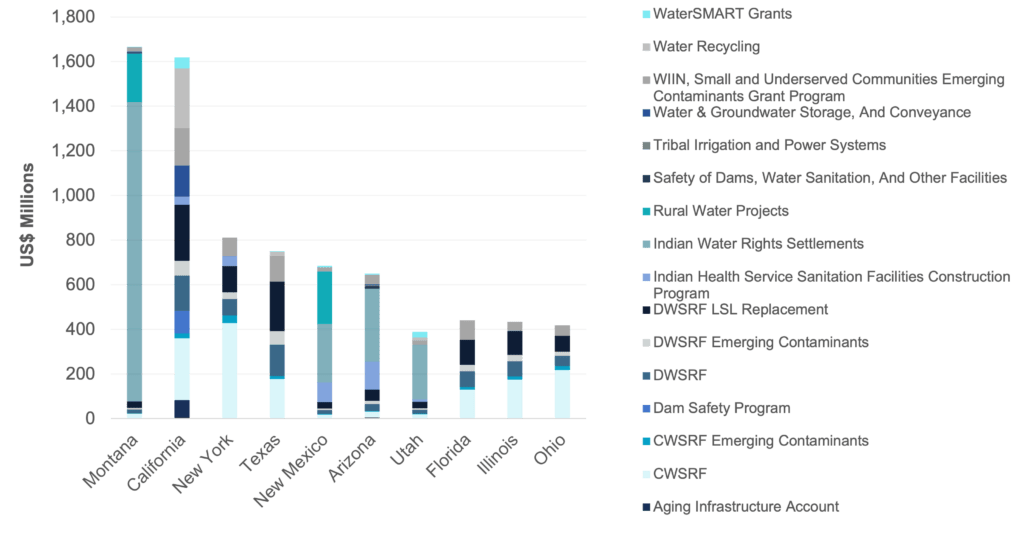

The distribution of announced IIJA funding to the water sector is largely influenced by each state’s individual funding needs. Montana leads all the states with US$1.7 billion in announced water sector funding to date, driven primarily by the US$1.3 billion its receiving for Indian Water Rights Settlements. California comes in second with allocations through a mix of funding channels, water recycling, including the largest sum of funds announced for the water recycling program, at US$267 million.

Exhibit: Announced Water Sector Funding—Top 10 States

Source: U.S. White House, Bluefield Research

As of March 2023, roughly 23% of all IIJA funds set to be distributed through Clean Water SRF and Drinking Water SRF channels over the legislation’s five-year funding horizon had been announced. When analyzing the SRF funding announcements for U.S. states, territories, and tribes announced through Q4 2022, the EPA was on track with their FY2022 funding plan. Their announced funding was at about 95% of where the EPA had planned to be by the end of the year, offering a positive note for the water sector. As 2023 progresses, and funds continue to make their way down from the state to project level, stakeholders will have a better idea as to the level of impact the IIJA has had in facilitating water infrastructure improvements across the nation since the legislation’s implementation.