Concerned with operating and replacing aging infrastructure, changing workforce dynamics, and increasing climate volatility, municipal water utilities are adopting advanced asset management strategies to maximize asset service life and prioritize capital investment for critical infrastructure.

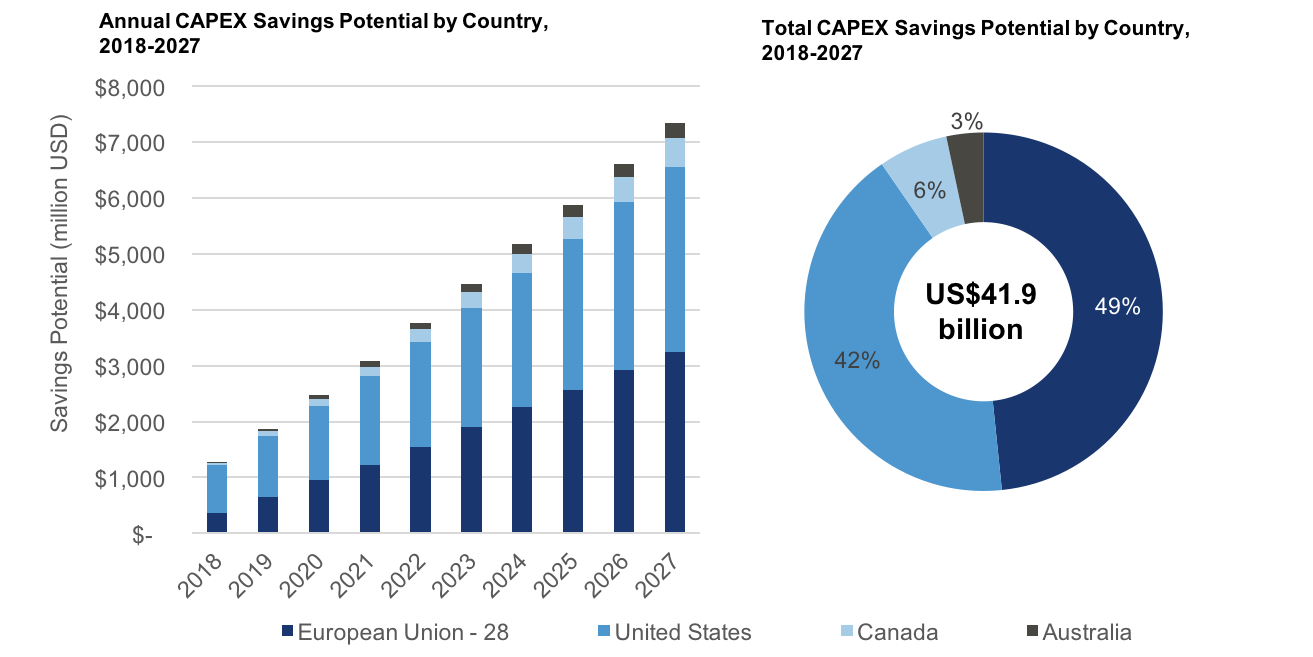

Bluefield’s report Advanced Asset Management in Municipal Water: Global Trends & Strategies, 2018 – 2027 predicts that smarter, more advanced asset management strategies will save water utilities US$41.9 billion in capital expenditures by 2027. These savings stem from the proliferation of new technology solutions aimed at improving asset management practices – the core function of utilities to ensure sustainable water and wastewater service provision in the long-term.

Utilities in the U.S., Canada, Australia, and Europe (representing 31 countries) currently manage US$2.9 trillion in water, wastewater and stormwater assets, which provide critical infrastructure services to over 822 million people, globally. Bluefield’s forecasts indicate that advanced asset management solutions will save these utilities US$1.2 billion in annual CAPEX savings in 2018 and scale to US$7.3 billion in annual savings by 2027.

Exhibit: CAPEX Savings by Country, 2018-2027 (Annual and Total)

Source: Bluefield Research

Source: Bluefield Research

Data and analytics drive advanced asset management strategies

Central to this shift toward more advanced asset management solutions is the increasing value in data collection, analytics, and visualization of network conditions and operations. Utilities are looking for ways to extend the service life of aging infrastructure assets and placing an increasing importance on data-based, predictive decisions, rather than being reactive.

Advances in machine learning and computation systems are disrupting age-old asset planning processes and improving how utilities more efficiently allocate capital. Firms like Copperleaf, SEAMS, and Servelec Technologies look to the U.K. market as a key battleground for advanced asset investment modeling solutions. Early-stage companies such as Fracta and Baseform are compiling utility pipe data from multiple sources (e.g. soil conditions, historical work-orders, hydraulic models, environmental conditions) and applying algorithms to generate predictive insights into the potential for asset failure.

Asset management segments are emerging as a key battle ground for innovative business models.

Bluefield sees a diverse group of players looking to capitalize on this opportunity, with companies across the municipal water value chain migrating towards strategic asset management decision-making from. From equipment providers like Xylem, modeling firms like Bentley, to select engineering consultancies, strategic asset management solutions have made way into their core offerings.

Adding to the sector’s competitive complexity, technology companies, including IBM and SAP, are looking to expand their positions, while diversified industrials ABB, GE, and Schneider Electric, have built-up digital business services through recent industry-agnostic acquisitions that are also applicable to water. At the same time, a number of venture capital backed companies are carving out positions, which could ultimately be rolled-up into larger portfolios via acquisition.

Advanced Asset Management in Municipal Water: Global Trends & Strategies, 2018 – 2027 deconstructs the complex processes that municipal water utilities undertake to manage their assets. Bluefield analyzes key market drivers and inhibitors, successful strategies of early adopting utilities, and profiles over 40 innovative solution providers.

Interested in the smart water opportunity and how it affects your industry? Follow Bluefield on LinkedIn for the latest market perspectives. Stay ahead of key trends in water infrastructure, reuse, advanced water treatment, water-energy-nexus, smart water and more.