28 February 2022, Boston, Massachusetts: Heightened awareness and newly available sources of funding for municipal water and sewer infrastructure have set the stage for over US$104 billion of hardware and equipment investments by municipal utilities in the U.S.

According to a new Bluefield Research report, U.S. Water & Sewer Pipe Network Infrastructure: Market Trends and Forecasts, 2022–2030, the myriad of network assets, including pipes, valves, manholes, and fire hydrants, makes up approximately 45% of utilities’ capital expenditures, when including labor. Underpinning this growth are new housing starts, a low interest rate environment, and more recently, the Infrastructure Investment & Jobs Act.

“Most people don’t think about the four million miles of pipes and equipment delivering clean water and collecting wastewater from residences, commercial buildings, and industrial facilities,” says Bluefield President & CEO Reese Tisdale. “From aging pipe network infrastructure to lead service lines, the spotlight is strengthening on what is traditionally an out-of-sight, out-of-mind utility pipe segment.”

The ten-year outlook varies widely by state, and Texas’s robust US$18.3 billion forecast points to key differentiators separating it from other states and regions. In addition to holding the nation’s largest installed base of water & wastewater pipe miles, a 161% increase in housing starts from 2010 to 2020 and continued strong population growth are propelling pipe network investments forward. Texas is followed by California, Florida, and North Carolina with a combined US$20.18 billion total.

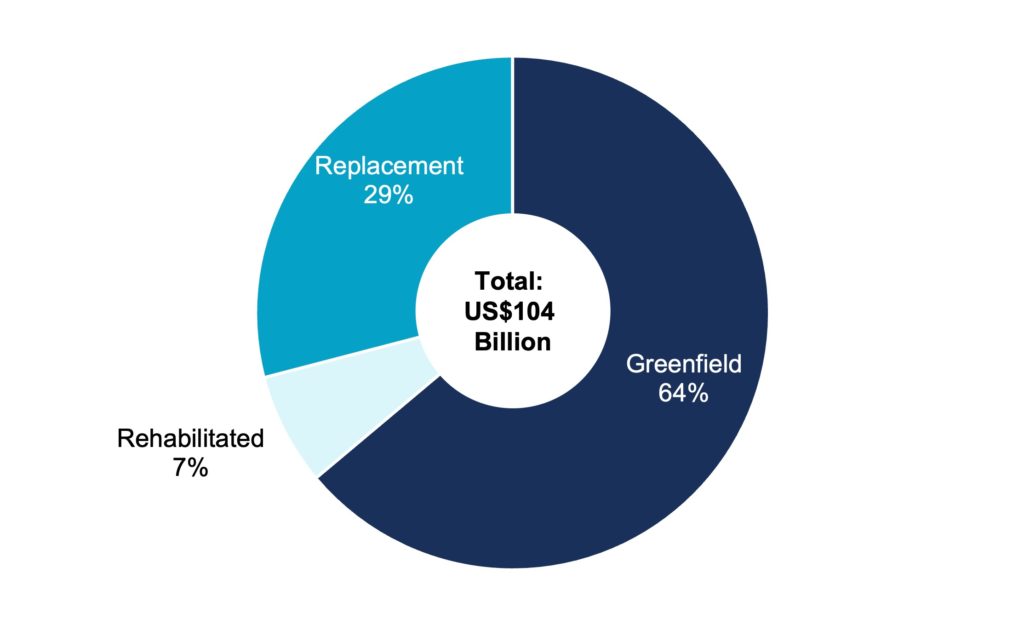

Bluefield’s 50-state analysis shows the majority (64%) of hardware equipment spend by utilities will go towards serving new, greenfield network infrastructure. The remaining 36% will be allocated to equipment replacement and rehabilitation of existing underground assets.

Exhibit: Underground Network Asset Investment Forecast: Greenfield, Replacement & Rehabilitation

Source: Bluefield Research

With a majority of the expenditures going to new build, particularly in the Sunbelt states, the overall share of pipe materials will continue to shift toward newer materials including plastic pipes (e.g., PVC, HDPE). At the same time, older, more densely populated urban areas, where aging infrastructure is of greater concern, will continue their reliance on more traditional, legacy materials, like ductile iron. Newer material types are growing faster than the water sector, as a whole, with average annual growth of 10% in plastic pipes, compared to 6% average annual growth for legacy materials.

The municipal utility market, like many others, also faces uncertainty ahead with respect to inflationary pressures. Acute supply chain constraints stemming from pandemic shutdowns, workforce disruption, and climate volatility (e.g., Texas Winter Storm), are driving record inflation in water and sewer pipe material prices. In some instances, prices for plastic, steel and iron pipes have shot upwards by more than 75.1% from October 2020 to October 2021.

“Rising labor, transportation, and hardware & equipment prices are exposing both buyers and sellers to potential project deferments until the market stabilizes,” says Tisdale. While it is still too early to tell whether utilities will begin deferring equipment purchases to wait for declines, the impact is going to be felt one way or another. It just might be the next capital budget cycle.”

Given the scale of distribution and collection networks, there remains significant opportunity to capture efficiencies. Utilities and their service providers are increasingly deploying digital technologies to more effectively target investment spend in their most critically underperforming underground assets.