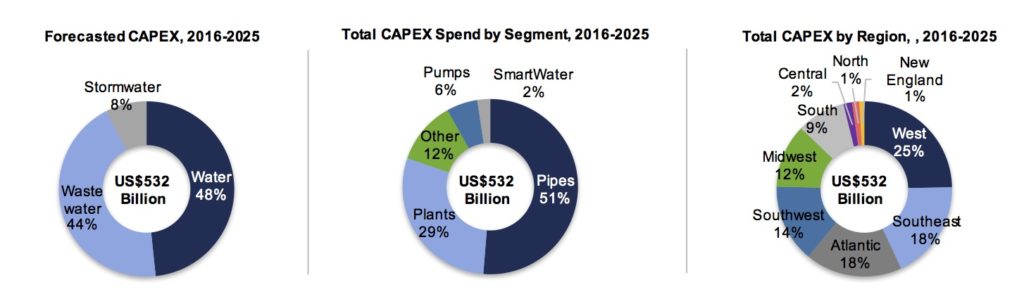

BOSTON – Capital expenditures (CAPEX) for U.S. municipal water & wastewater utilities – including spending on pipes, plants, and pumps – are expected to exceed $532 billion between 2016 and 2025, according to new forecasts from Bluefield Research. This new outlook, which draws heavily from planned utility budgets, represents a 28% increase over CAPEX during the last ten years.

“Our research indicates that the water utility sector has finally emerged from the economic downturn, which undercut public spending in water infrastructure by almost 15% from 2009 to 2014,” according to Reese Tisdale, President of Bluefield Research. “We anticipate a surge of network upgrades to address aging infrastructure, scaling populations, and tightening environmental regulations nationwide that will usher in new infrastructure technology and financing solutions.”

While CAPEX is forecasted to rebound, a significant decrease in federal funding for water utilities– which has fallen to $4.3 billion in 2014 from $16 billion in 1976– passes the burden onto states, municipalities, and ultimately ratepayers. Residential and sewer bills have increased 5% and 20% annually, respectively since 2000, but their impact is expected to continue falling short of infrastructure needs.

Growth opportunities emerge within mature market sector

The enormity of the municipal sector’s capital requirements is compelling utility decision-makers to adopt new, more advanced and cost effective approaches to infrastructure management and build-out, according to Bluefield’s report. Going forward, markets for trenchless technologies, real-time data & analytics, or smart water, and advanced treatment solutions are expected to show significant growth. Opportunities for private capital in the municipal water sector are also expected to proliferate.

Staying ahead of 1.6 million miles of rapidly aging underground water and wastewater pipe networks poses the single largest financial challenge facing the nation’s municipal water utilities. Bluefield has forecasted an almost doubling of CAPEX on pipe networks from the previous decade, reaching nearly $300 billion over the ten-year period. While construction companies and traditional pipe suppliers will maintain a stronghold on the spend, adoption of cured-in-place pipe rehabilitation and pipe bursting replacement is expected to surge as utilities seek to extend the life of installed pipe networks with limited system disruption.

A critical input for utilities to address overall system issues most efficiently will be found through data & analytics solutions, or smart water. Without more real-time insights into customer demands, network leakages, and bill management, utilities will continue to struggle with capital and operating costs, as well as cost recovery. Bluefield forecasts the burgeoning smart water sector to total $12 billion over the forecast period.

“Unfortunately, all of this spend is not expected to cover the full cost to catch up to an aging system, particularly if the federal government is not going to step in,” reflects Mr. Tisdale. “It is for this reason, among others, that public-private partnerships will begin to take on greater significance. They enable deployment of more advanced solutions in an industry that does not lack technology options, but rather capital.”

These and other findings are found in Bluefield’s new forecasts U.S. Municipal Water Infrastructure: CAPEX Forecasts and Utility Strategies, 2016-2025. Bluefield water experts have addressed the 50-state forecast through a mix of bottom-up data analysis collected from the largest U.S. utilities and top-down insights from government agencies and company assessments.

About Bluefield Research

Bluefield Research provides data, analysis and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision-makers at municipal utilities, engineering, procurement, & construction firms, technology and equipment suppliers, and investment firms.