Bluefield has been analyzing M&A, ownership positions, and investment strategies in the municipal water utility sector since our firm’s founding. In doing so, the interest in private participation in water is even more evident and is being shaped by established players like Aqua America, regionally portioned firms, and a host of “outsiders looking in.” It is within this latter group that a growing roster of diversified infrastructure players is exacting their influence.

According to our report, including a section heading, Diversified Infrastructure Providers Reshaping Private Water Landscape, the U.S. municipal water landscape is undergoing a transformation as critical infrastructure services—water, gas, and electricity—converge under a single, investor-owned utility banner. The just-released report provides in-depth analysis of investor-owned water utility strategies and of 517 water and wastewater system acquisitions from 2015 through 2018, including Eversource Energy’s US$1.68 billion for Aquarion Water, NW Natural’s roll-up of smaller systems in the Pacific Northwest, and Aqua America’s US$4.3 billion acquisition of People Gas.

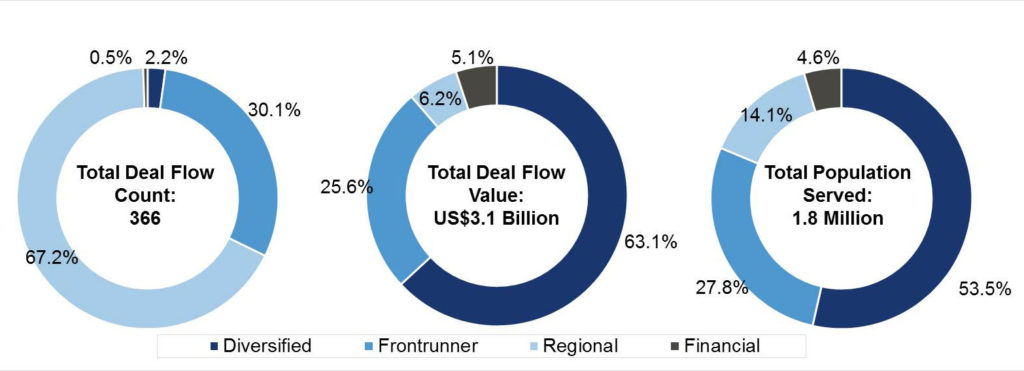

Of the 517 transactions identified by Bluefield from 2015 to 2018, private buyers executed 366 of them. While ushering in new market entrants and reshaping the competitive landscape, regionally, these deals also reflect a growing interest in private investment in the U.S. municipal water sector from water industry outsiders.

Exhibit: Deal Flow by Private Company Profile

Source: Bluefield Research

The consolidation of critical infrastructure services is not a new phenomenon, and current market conditions are re-reinforcing this trend. It wasn’t all that long ago, in 2001, that German electric power company RWE acquired American Water for US$7.6 billion, only to spin it out in 2008. This most recent wave of M&A feels different in that municipalities and system owners are being forced to weigh the benefits of outsourcing against owning and operating a portfolio of aging assets.

These diversified service providers—now active in water—are poised to gain from their proven experience with utility commissions, rate cases, customer management, and infrastructure finance. They are also going head-to-head with well-established IOUs, demonstrated by Eversource’s competing bid—against SJW Group—for northeast regional IOU, Connecticut Water. Given the mounting financial, regulatory, and environmental pressures on municipal water and wastewater systems—particularly for smaller, private system owners—the steady flow of M&A is expected to continue and open the door further to new entrants.

While the municipal market, as a whole, is highly fragmented, the private share of the market is more structured. The IOU landscape is segmented among well-established frontrunners (e.g. American Water, California Water Services, Suez), regional firms (e.g. Artesian Water, Central States Water), diversified service providers (e.g. Eversource Energy, American States), and a circling group of financial investors (e.g. PGGM, Ridgewood Infrastructure, Pacolet Milliken). Private ownership of U.S. municipal water systems currently stands at 15%, of which approximately half is held by these IOUs, according to Bluefield’s analysis.

Annual capital and operating expenditures for public systems are already approaching US$60 billion (free with registration) and US$90 billion by the end of the decade. What is more concerning is that this does not fully account for the looming external pressures on system operators, including larger, more frequent stormwater events, algae blooms, and PFAs remediation that will heighten needs for capital, operating experience, and advanced technologies.

Underpinning this scaling interest in municipal water infrastructure investments from outsiders and insiders is a more favorable policy environment enabling acquisitions of community water and wastewater systems. Fair Market Value (FMV) policies in nine states—and pending legislation in others—are incentivizing municipalities to sell utilities based on appraised value rather than book value. Still, over 60% of acquisitions are for private systems, rather than those owned by municipalities.

There is no one answer to addressing aging water infrastructure in the U.S., including ownership, private or public. What we are seeing through M&A and evolving ownership positions, however, is an indication that municipalities, utility leaders, regulators, and infrastructure players are beginning to change their thinking.

This change could also set us on a path to shared communication networks, more connected infrastructure, and smarter cities.